Table of Content

- Silver Price Forecast Overview

- Global Market Trends

- Key Drivers Affecting Silver Prices

- Silver Price Forecast for Nepal 2025–2026

- Industrial Growth and Supply Conditions

- Investment Outlook and Risks

- Where to Check Latest Silver Prices

- Stay Updated With PrimeWrites.com

Recent Silver Prices in Nepal

Silver price forecast for 2025 and 2026 suggests a strong upward trend, driven by growing global demand from green technology, rising investment interest and tight supply conditions. These factors are already pushing prices higher worldwide and the impact is clearly visible in Nepal’s market too.

Silver prices move quickly, so staying informed helps you make better investment decisions. If you want reliable updates on prices, global forecasts and financial news in one place, you can follow PrimeWrites. It covers trending topics including precious metals, the economy and markets.

📌 For regular price updates and business insights: Visit primewrites.com

You can check real-time silver movement, upcoming market predictions, and helpful articles whenever you need them. Keeping up with the latest data allows you to plan your investments with more confidence.

Silver prices have been rising worldwide, and Nepal is directly feeling that impact. Strong demand from green technology, limited supply growth, and global economic uncertainty are helping support higher prices. Many analysts think silver could continue climbing in 2025 and 2026.

Below is a straightforward look at what is happening globally and what that could mean for Nepal.

Global Price Trends

Recent data shows silver has been trading near record highs.

- Global spot silver has climbed above US $60 per ounce for the first time.

Silver has seen one of the strongest performances in metals. Demand from energy transition technology continues to increase. This includes solar panels, semiconductor chips, and electric vehicles.

What Is Driving Silver Higher?

Here are the main global factors creating upward pressure:

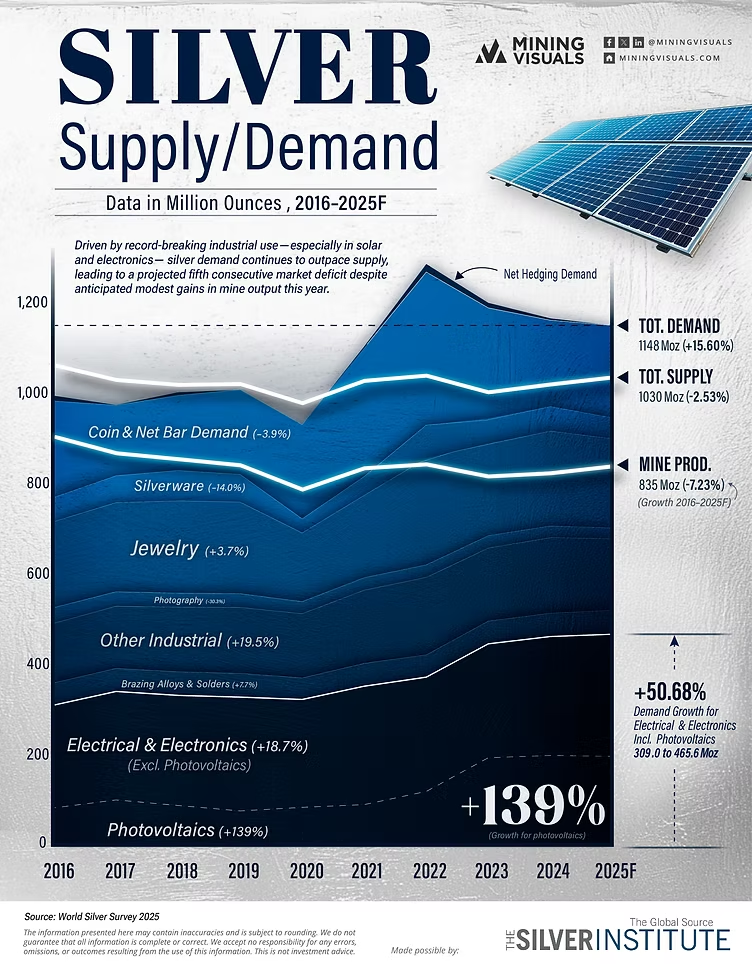

1. Industrial growth

Silver demand from solar panels and electronic components has reached new levels. Datacenter growth and AI investments are also boosting consumption.

2. Supply tightness

Production is not keeping up. Most silver comes as a by-product from other metals, so mining cannot easily scale up.

3. Safe-haven buying

Concerns about inflation, weak currency strength, and market instability are pushing some investors toward precious metals.

These forces together make silver a unique metal: part industrial, part investment asset.

Forecasts for 2025–2026

Analysts offer different ranges based on how strong demand remains.

| Forecast Scenario | Estimated Price Range | Notes |

|---|---|---|

| Base Case | US $55–65/oz | Paired with steady demand and tight supply |

| Bullish | US $75–90/oz | If solar and EV markets accelerate further |

| Extreme Bull Case | US $100+/oz | Likely only if global supply issues worsen |

Even the moderate view expects prices to remain well above earlier years.

Silver price forecast for 2025 and 2026 points toward a continued rise as global demand strengthens and supply remains tight. Analysts believe this silver price forecast trend will stay positive because silver is essential in solar panels, electronics and electric vehicles. When we look closely at international charts, the silver price forecast shows strong investor confidence as well.

In Nepal, the silver price forecast is also influenced by the US dollar exchange rate and traditional demand during festivals and weddings. Local traders expect the silver price forecast to remain bullish as global markets continue to push prices higher. Investors who follow the silver price forecast can plan better and make smarter decisions about buying or selling.

Another major factor that supports the silver price forecast is industrial expansion in green technology. Even if prices fluctuate in the short term, long-term projections remain strong. With limited mining output and rising consumption, the silver price forecast suggests we may see new highs in 2026.

For people saving in precious metals, staying updated with the silver price forecast helps protect value against inflation and currency changes. Nepal’s silver market has already shown strong growth, and ongoing reports confirm a positive silver price forecast for the coming years.

Nepal Market: What to Expect

Nepal follows global pricing but adds domestic effects:

- Exchange rate fluctuations (USD to NPR)

- Local demand from festivals, weddings, and savings

- Import costs and dealer margins

When global prices hit record levels, Nepal typically hits new highs too.

Silver has shown strong appreciation in Nepal over the long term. If global forecasts hold, prices in Nepal could continue rising and possibly set new records in 2026.

Opportunities and Risks

Like any investment, silver comes with pros and cons.

Why people in Nepal may consider silver

- More affordable than gold

- Culturally accepted asset to store value

- Demand likely to grow over the long run

What to remain aware of

- Prices are volatile

- Industrial slowdown could reduce demand

- A stronger US dollar can raise import costs

Silver tends to swing more sharply than gold. It can deliver strong returns but it requires patience and a willingness to handle short-term dips.

Key Takeaway

Silver is in a strong cycle driven by real industrial needs. Predictions suggest the upward trend could continue into 2026. Nepal will feel most of the same momentum as the global market, though currency trends and seasonal demand may cause extra fluctuation.

If you are considering silver as part of a savings plan or diversified investment, this period may continue offering opportunities. Just be sure to keep an eye on global pricing and the USD exchange rate.

For reliable updates on every kind of news and information, visit primewrites.com.